Donate

Find out about our current fundraising priorities on our giving website and read more about the difference you can make.

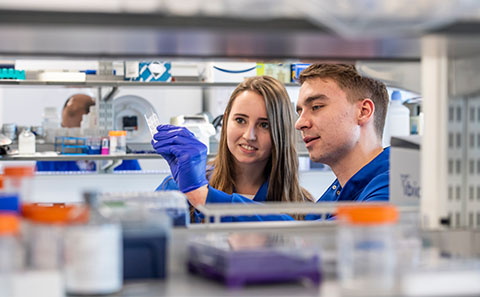

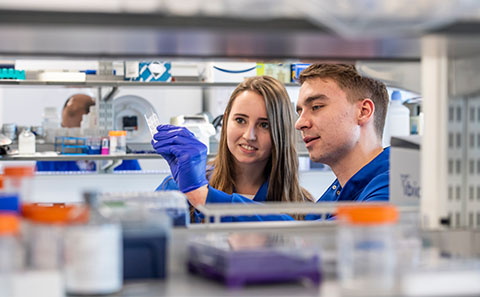

At Southampton, we’re a community. From our staff and students to our many thousands of connected alumni and supporters around the world. Working together makes us stronger—helps us tackle global challenges and break down barriers.

We improve and save lives through transformative research. We nurture and support students from all backgrounds through our inclusive programmes. You can help us do more. Whether it’s through giving time, donating, or by spreading the word—it all makes a difference. Join in with Southampton Together today and be a part of achieving the remarkable.

Find out about our current fundraising priorities on our giving website and read more about the difference you can make.

You can change the lives of students at Southampton by offering your skills and expertise and volunteering your time to one of our many opportunities.

Hear from students, patients and members of our University community how our generous donors and volunteers are making a real difference to lives

Watch videoTo keep updated on all the latest Southampton Together developments and opportunities, make sure to follow us on social media.